Top AML Solutions in 2024

Financial institutions must continually adapt to the ever-evolving landscape of anti-money laundering (AML) in order to remain ahead of sophisticated financial crimes. Businesses must invest in strong AML solutions as a result of increasingly strict regulations. The best AML solutions for 2024 will be revealed in this blog post, along with an analysis of their salient characteristics. Financial institutions can improve their compliance systems, reduce risks, and eventually remain ahead of the curve in the battle against financial crime by utilizing these cutting-edge solutions.

What Is Anti-Money Laundering (AML) Software?

Software specifically designed to assist financial institutions and enterprises in preventing, detecting, and mitigating money laundering activities is known as anti-money laundering (AML) software. Money laundering is a sophisticated financial crime in which offenders try to pass off the source of monies gained through illicit means as lawful. AML software gives businesses access to a number of tools and features that help them spot suspicious activity, keep an eye on transactions, investigate customers, and make sure they are following the law.

At its core, AML software automates and streamlines the process of identifying potential money laundering risks. In order to find patterns, abnormalities, and suspicious activity, it examines huge amounts of transaction data, customer information, and information from outside sources. Advanced analytics, machine learning algorithms, and artificial intelligence are utilized by AML software to detect intricate money laundering schemes, encompassing actions such as structuring, shell company operations, and the use of money mules.

A key component of AML software is customer due diligence (CDD) and know-your-customer (KYC) processes. These involve:

Customer identification and verification. AML software helps in collecting and verifying customer identification information, such as names, addresses, dates of birth, and government-issued IDs. This ensures that customers are who they claim to be and helps prevent identity theft or impersonation.

Customer risk assessment. Assessing each customer’s risk is the main component of the CDD process. AML software examines a variety of variables, including the customer’s business or line of work, political inclination, place of residence, and funding source. This risk assessment aids in figuring out how much attention and oversight is right for each individual consumer.

Ongoing monitoring and transaction analysis. KYC processes don’t just end with customer onboarding. AML software continuously monitors customer transactions to detect suspicious activities or deviations from normal behavior. It may include setting transaction limits, monitoring high-risk jurisdictions, and analyzing transaction patterns to identify potential money laundering red flags.

Sanctions and watchlist screening. Sanctions and watchlists from law enforcement and regulatory organizations are included into AML software. Customers are screened against these lists in order to flag and identify individuals or entities that are flagged for political or reputational risk to the institution, are known to be involved in criminal activity, or are subject to penalties.

AML software plays a critical role in helping financial institutions combat the complex issue of money laundering. By leveraging advanced technologies and streamlined processes, AML software enables organizations to stay compliant, protect their reputation, and contribute to the broader effort of disrupting financial crimes.

The Best Anti Money Laundering (AML) Software & Tools

The fight against financial crime is an ongoing challenge, and organizations are increasingly turning to technology for support. Let’s explore some of the best AML software and tools available in the market today.

SEON

SEON is a top supplier of AML and anti-fraud solutions, providing a cutting-edge toolkit to tackle financial crimes. SEON’s powerful analytics and behavioral profiling engine uses artificial intelligence and machine learning to identify suspicious activity. SEON’s platform can be tailored to meet the specific needs of businesses across various industries, including banking, fintech, and e-commerce.

Organizations may successfully identify high-risk companies and persons with the help of the SEON’s capabilities, which include sanctions screening, unfavorable media monitoring, and behavioral anomaly identification. SEON’s technology streamlines AML compliance efforts by facilitating efficient investigative procedures via automated case management and full reporting features.

One of the key advantages of SEON’s AML solution is its flexibility in data sourcing. The platform can integrate multiple data sources, including traditional financial data, alternative data, and even proprietary data sets specific to the organization’s requirements. This flexibility ensures a more nuanced understanding of risk and enables businesses to make more informed decisions.

Acuris Risk Intelligence

Acuris Risk Intelligence, a Refinitiv company product (an American-British global provider of financial market data and infrastructure), is a trusted provider of AML solutions, offering a comprehensive suite of tools to help organizations fortify their defenses against financial crimes. Acuris Risk Intelligence stands out for its extensive data coverage and advanced analytics, offering a robust framework for AML compliance.

At the heart of Acuris Risk Intelligence AML solution is its vast database, which aggregates information from thousands of global sources, including news outlets, regulatory filings, watch lists, and more. This comprehensive data gathering ensures a 360-degree view of potential risks, enabling organizations to identify red flags and hidden connections that may indicate money laundering activities. The platform’s advanced analytics and sophisticated algorithms parse through this data, applying natural language processing and machine learning techniques to uncover relevant insights and patterns.

One of the key strengths of Acuris Risk Intelligence is its ability to provide enhanced due diligence. Their AML solution facilitates a deeper understanding of customers, suppliers, and partners through comprehensive screening and monitoring. The platform offers sanctions and PEP (Politically Exposed Persons) screening, adverse media monitoring, and behavioral analysis, helping organizations identify high-risk entities and individuals.

ComplyAdvantage

ComplyAdvantage is a leading provider of innovative AML solutions. Their AML platform stands out for its advanced machine learning capabilities and comprehensive data coverage, providing organizations with powerful tools to manage their AML compliance effectively.

One of the key strengths of ComplyAdvantage’s AML solution is its advanced machine learning engine, which leverages large-volume data sets and sophisticated algorithms to detect patterns and identify potential money laundering red flags. The platform’s machine learning models are trained to analyze complex relationships and behavioral patterns, enabling more accurate risk assessments and reducing false positives.

The wide range of functionalities of ComplyAdvantage’s AML solution includes sanctions screening, enabling organizations to screen against global watch lists and identify potential matches efficiently. The platform also provides adverse media monitoring, scouring thousands of news sources and public records to uncover negative events and associations that may impact an entity’s risk profile. Additionally, ComplyAdvantage’s platform facilitates customer risk profiling, entity resolution, and ongoing transaction monitoring, providing a holistic view of potential risks.

Another standout feature of ComplyAdvantage is its global data coverage. The platform aggregates information from a vast network of trusted data sources, including regulatory and law enforcement agencies, government bodies, and media outlets.

Dow Jones Risk & Compliance

Dow Jones Risk & Compliance, a prominent provider of AML solutions, offers a comprehensive suite of tools to assist businesses in strengthening their defenses against financial crimes. Their AML solution is renowned for its extensive data coverage, robust due diligence capabilities, and advanced analytics, providing organizations with the necessary framework to effectively manage compliance and mitigate risks.

One of the key advantages of Dow Jones Risk & Compliance is its vast and trusted data repository. The company aggregates information from thousands of reputable sources worldwide, including media outlets, regulatory filings, government records, and watch lists. This comprehensive data aggregation ensures that organizations have access to the most current and reliable information for effective AML screening and monitoring. The platform’s data coverage spans across various risk areas, such as sanctions, politically exposed persons (PEPs), and adverse media.

GBG

One of the key strengths of GBG’s AML solution is its advanced identity verification and authentication capabilities. The platform leverages cutting-edge technologies, including artificial intelligence and machine learning, to validate and verify customer identities with a high degree of accuracy. GBG’s solution can analyze multiple identity documents, perform biometric checks, and assess liveness detection, ensuring that businesses know their customers (KYC) and can detect potential fraud or identity theft.

The GBG AML platform offers a comprehensive suite of due diligence tools. It provides detailed insights into ultimate beneficial ownership (UBO), enabling businesses to identify and verify the individuals who ultimately own or control a company. This level of transparency is crucial for complying with regulatory requirements and preventing illicit activities. The platform also includes adverse media screening, scouring thousands of global sources to uncover negative news or associations that may impact an entity’s risk profile.

Sumsub

Sumsub, a leading global provider of AML and KYC solutions, provides organizations with a robust framework to navigate the complex world of AML compliance.

One of the key strengths of Sumsub’s AML solution is its automation capabilities. The platform leverages advanced optical character recognition (OCR) and artificial intelligence (AI) technologies to extract and analyze data from identity documents, reducing manual efforts and potential human errors. Sumsub’s automated customer onboarding process includes identity verification, biometric matching, and document authenticity checks, ensuring a seamless and secure experience for legitimate customers.

iDenfy

iDenfy, a trusted global provider of AML and KYC solutions, offers an innovative platform to help businesses stand against financial crimes. iDenfy’s platform stands out for its accuracy, ease of use, and comprehensive identity verification capabilities, making it a reliable choice for businesses seeking to effectively mitigate AML risks.

One of the key advantages of iDenfy’s AML solution is its advanced identity verification technology. The platform employs a multi-layered approach to validate the authenticity of identity documents and verify the identity of individuals. iDenfy’s AI-powered document verification checks for tampering or forgery, ensuring the integrity of the provided documents. Additionally, their facial recognition technology matches the live selfie of an individual with the photo on the identity document, preventing identity fraud and ensuring a secure onboarding process.

Onfido

Onfido offers a cutting-edge platform that empowers businesses to fight against money laundering. Onfido’s platform stands out for its machine learning capabilities, automation, and seamless user experience, making it a trusted choice for businesses.

One of the key strengths of Onfido’s AML solution is its machine learning-powered identity verification. The platform utilizes advanced machine learning algorithms to analyze and verify identity documents, detecting potential fraud or tampering with high accuracy. Onfido’s technology can authenticate a wide range of global identity documents, including passports, driver’s licenses, and national IDs, ensuring a comprehensive and reliable verification process.

Through automated document extraction and advanced optical character recognition (OCR), the platform efficiently captures and verifies customer information, reducing manual interventions and potential errors. This automation enhances the accuracy and efficiency of AML checks.

Ondato

Ondato is a comprehensive and innovative platform that stands out for its flexibility, customization options, and a strong emphasis on ensuring a seamless customer experience.

One of the key advantages of Ondato’s AML solution is its flexibility and adaptability. The platform offers a modular structure, allowing businesses to customize and tailor the AML solution according to their specific requirements. This flexibility ensures that organizations can effectively address their unique risk profiles and compliance needs, whether they operate in banking, fintech, cryptocurrency, or other regulated industries.

Another standout feature of Ondato’s AML solution is its comprehensive identity verification capabilities. The platform employs advanced technologies, including biometric identification and liveness detection, to ensure the accurate and secure verification of individuals. Ondato’s AI-powered document verification checks the authenticity of identity documents, preventing identity fraud and ensuring compliance with regulatory requirements.

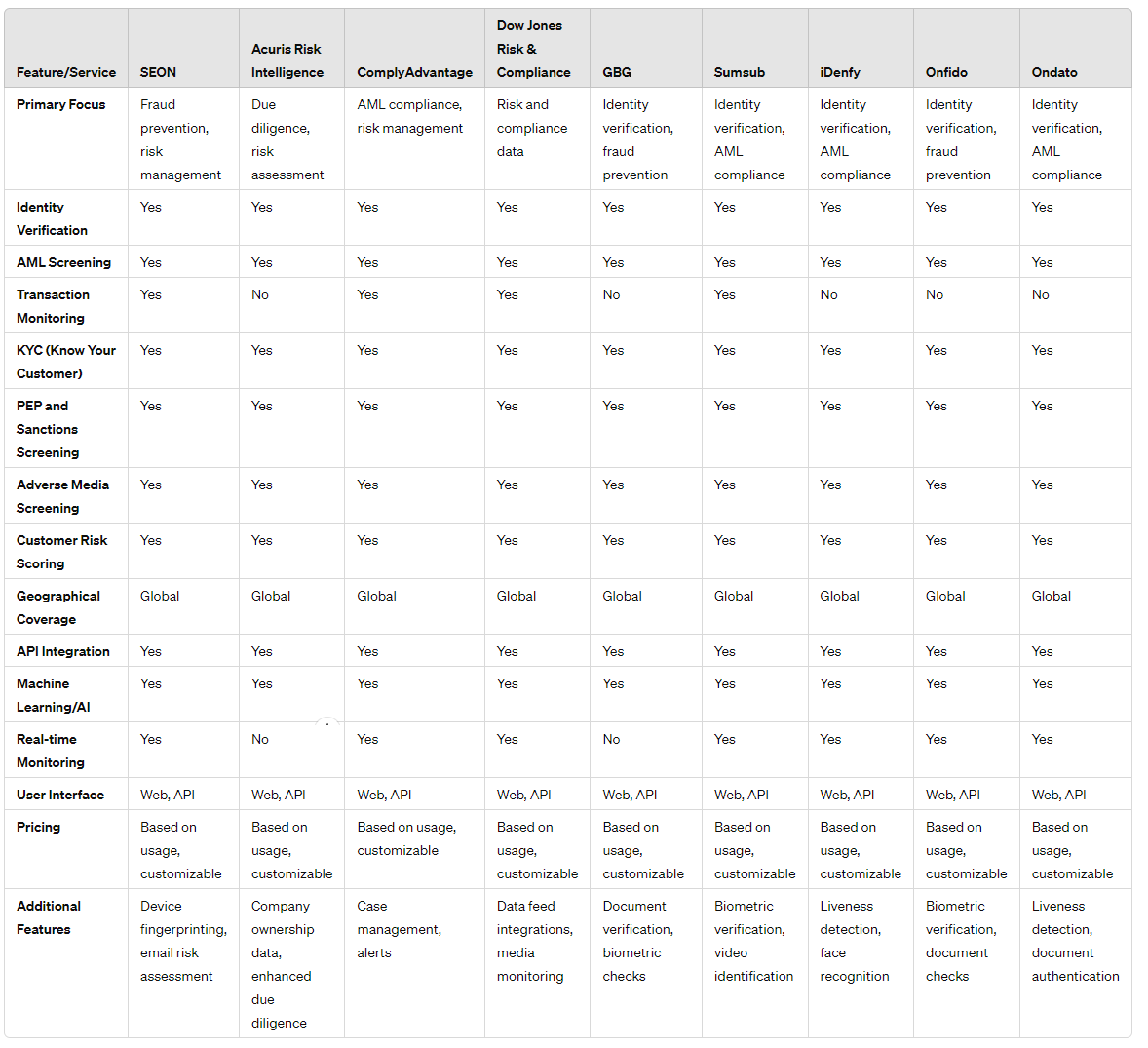

The Table of Comparison

Here is a table of comparison to help you sum up the information.

How to choose the right AML solution?

When faced with the critical task of selecting an AML solution, it is imperative to approach this decision with careful consideration and a nuanced understanding of your organization’s unique needs.

First and foremost, ensure that the AML solution aligns with the regulatory framework pertinent to your industry and geographic location. The world of regulatory compliance is intricate and ever-evolving, so seek a solution backed by a provider with a profound understanding of these complexities. Their guidance in navigating the specific standards and requirements of your jurisdiction is invaluable.

As you assess potential AML solutions, look for a comprehensive suite of functionalities. The solution should offer a robust framework encompassing identity verification, Know Your Customer (KYC) processes, sanctions screening, transaction monitoring, and ongoing customer due diligence.

Technology plays a pivotal role in the effectiveness of AML solutions. Opt for solutions that use the power of artificial intelligence (AI), machine learning, and automation. These advanced technologies enhance accuracy, efficiency, and adaptability. Machine learning algorithms discern patterns and anomalies, improving the detection of suspicious activities. Automation streamlines repetitive tasks, reducing errors and allowing your team to focus on strategic initiatives.

Conclusion

With the constant evolution of money laundering schemes and the increasing complexity of global financial regulations, organizations must be vigilant in their defense strategies. This blog post has presented a comprehensive overview of the top AML solutions that are leading the way in 2024. Each solution showcased here offers a unique combination of innovative technologies, robust data sources, and tailored features to meet the diverse needs of businesses across industries. As you consider your organization’s AML partner, remember to evaluate their track record, flexibility, and commitment to staying ahead of regulatory changes. By selecting from the best AML solutions, you can confidently strengthen your compliance posture and contribute to a more secure financial world.