Top KYC Services in 2024

The landscape of KYC services is constantly evolving, with new technologies and regulations shaping the industry. No wonder it is hard to make up one’s mind and choose the right tool to suit your needs.

In this blog post, we will explore the top KYC solutions of 2024 and how they can help businesses streamline their onboarding process and enhance security measures. Let’s find the best KYC services for your business needs.

About KYC

KYC, or Know Your Customer, is a process businesses use to verify the identities of their clients. This helps prevent financial crimes like money laundering, identity theft, and terrorism financing. During KYC, you'll typically provide government-issued ID (like a driver's license or passport) to verify your identity and address.

KYC plays a vital role in Anti-Money Laundering (AML) programs, which use various measures to combat financial crimes. By verifying identities and performing due diligence, KYC helps authorities make it harder for criminals to operate. This protects businesses and the financial system as a whole.

Beyond security, KYC can also improve efficiency. Automated KYC systems can streamline the onboarding process, making it faster and easier for you to become a customer. Facial recognition technology is a growing trend in KYC, offering a secure and convenient way to verify your identity without needing to meet someone in person.

Learn more here: KYC: What is it and How Does it Work?

Top KYC Services: Features, Benefits, and Drawbacks

With so many options on the market, how do you pick the best KYC solution for your company? To help you make an informed choice and select the best KYC service for your company, we will examine the features of the top 2024 KYC services.

Luxand.cloud KYC Solution

Luxand.cloud KYC software allows you to simply create automated KYC and integrate our platform with or without engineers. The available ready-to-use templates for KYC onboarding make it simple to construct logic to determine what can be automatically authorized or rejected. You can change everything about your verification flows, collection techniques, user experience, and friction spots.

Advantages

Luxand.cloud's KYC solution is based on the facial recognition technologythat is highly accurate and reliable, ensuring that identity verification processes are carried out with precision.

Whether you're a small startup or a large enterprise, Luxand.cloud's KYC solution can be easily scaled to meet your growing needs.

Facial recognition provides an additional degree of protection to the KYC process. Businesses can reduce the risk of identity fraud and illegal access by confirming people's identities using biometric data.

Disadvantages

Luxand.cloud provides custom pricing only. Without clearly defined pricing tiers, it may be difficult to compare charges with comparable providers.

Integrating KYC based on facial recognition technology into current systems and workflows may necessitate significant effort, resources, and technical skill.

To learn more about Luxand.cloud KYC solution, visit our webpage - Face Recognition Solution for KYC Identity Verification.

Jumio

Jumio KYC system is known for its user-friendly interface and cutting-edge AI technology, Jumio is a popular choice among businesses looking for a seamless KYC experience. From ID verification and facial recognition to address verification and watchlist screening, Jumio offers a wide range of features to meet the diverse needs of its clients.

Advantages

Jumio's technology employs advanced algorithms and AI to verify identity documents accurately, reducing the chances of false positives or false negatives.

Facial recognition technology in Jumio represents a cutting-edge solution for businesses who can now verify the identities of their customers with unprecedented efficiency. By capturing high-resolution images and comparing them against stored data, Jumio’s facial recognition system verifies the identity of customers even in challenging conditions such as low lighting or varied facial expressions.

Jumio's solutions are designed to meet regulatory compliance standards, ensuring that businesses adhere to KYC and Anti-Money Laundering (AML) regulations.

Disadvantages

Implementing Jumio KYC can be expensive, especially for smaller businesses or startups with limited budgets. The cost includes not only the initial setup but also ongoing fees for usage and maintenance.

Like any automated system, Jumio KYC may generate false positives (flagging legitimate customers as suspicious) or false negatives (failing to flag actual suspicious activity). This can result in inconvenience for customers or regulatory non-compliance for businesses.

Integrating Jumio KYC into existing systems can be complex, requiring time and resources for seamless implementation. It may also require changes to user interfaces or workflows, which can disrupt operations.

Trulioo

Trusted by leading organizations worldwide, Trulioo KYC system stands out for its global coverage and extensive data sources. With access to over 400 data points from more than 200 countries, Trulioo enables businesses to verify identities quickly and accurately, even in the most remote corners of the world. However, users may encounter occasional delays in response times during peak hours.

One of the standout features of Trulioo’s identity verification solutions is its global coverage, which spans over 200 countries and territories. Trulioo employs a comprehensive approach to identity verification, leveraging a wide range of data sources and advanced technologies to ensure the authenticity of customer identities.

Advantages

Trulioo has access to a vast network of reliable data sources globally, enabling businesses to verify the identities of customers from various countries. This extensive coverage helps in compliance with local regulations across different jurisdictions.

Trulioo's automated KYC processes significantly expedite the onboarding of new customers. With real-time identity verification capabilities, businesses can streamline their operations and offer a seamless user experience without compromising security or compliance.

Trulioo stays updated with evolving regulatory requirements worldwide. Its platform is designed to adapt to changing compliance standards, ensuring that businesses remain compliant with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

Disadvantages

Trulioo's services may be expensive for smaller businesses or startups, potentially making it prohibitive for them to afford comprehensive KYC checks.

Implementing Trulioo's KYC solutions can be complex, especially for businesses that lack experience or expertise in identity verification processes. Integration with existing systems and workflows may require significant time and resources.

Trulioo relies on data from various third-party sources for identity verification. Any inaccuracies or delays in these sources could impact the effectiveness and reliability of Trulioo's KYC services.

Onfido

Onfido KYC solution offers a robust KYC solution that prioritizes security and accuracy. From ID document verification and facial recognition to liveness detection and fraud prevention, Onfido’s platform is designed to deliver a seamless onboarding experience for both businesses and customers. ID document verification and facial recognition are two key components of Onfido’s robust identity verification solution, offering businesses unparalleled accuracy and security in verifying customer identities.

Advantages

Onfido’s ID document verification feature allows businesses to verify the authenticity of government-issued identification documents provided by customers. Using advanced algorithms and optical character recognition (OCR) technology, Onfido analyzes the document for signs of tampering, forgery, or inconsistencies, ensuring that only legitimate IDs are accepted.

Onfido’s facial recognition technology takes identity verification to the next level by capturing and analyzing facial biometrics of customers. Customers are prompted to take a selfie or live video, which Onfido compares against the photo on their ID document. By measuring unique facial features such as eye distance, nose shape, and facial contours, Onfido verifies the identity of customers with remarkable accuracy. By combining ID document verification and facial recognition, Onfido offers businesses a comprehensive and seamless identity verification solution that enhances security, builds trust with customers, and ensures compliance with regulatory requirements.

Onfido's user-friendly interface and seamless integration with existing workflows provide a positive user experience for both businesses and customers, leading to higher satisfaction and retention rates.

Disadvantages

Onfido's automated verification process may sometimes flag legitimate users as suspicious, leading to unnecessary delays or rejections.

Users may be hesitant to share sensitive personal information with a third-party service like Onfido, raising privacy concerns.

Onfido's verification process may not be available or suitable for all regions or types of identity documents, limiting its effectiveness in certain markets.

Implementing Onfido's services can be costly, especially for businesses with large customer bases or high verification volume.

Sumsub

Sumsub KYC software offers AI-driven compliance solutions for identity verification, KYC, and AML screening. Its document verification supports multiple languages and formats, ensuring global compliance. Sumsub employs biometric facial recognition and liveness detection for enhanced security. The platform integrates AML screening to identify and prevent fraudulent activities, and it allows customization of KYC workflows to align with specific regulatory requirements.

Advantages

Sumsub supports identity verification for customers from around the world, making it suitable for businesses with international operations or customer bases.

Sumsub's platform is flexible and customizable, allowing businesses to tailor the KYC process to their specific needs and regulatory requirements.

Sumsub focuses on providing a seamless and user-friendly experience for both businesses and customers, leading to higher satisfaction and retention rates.

Sumsub prioritizes data security and compliance, implementing robust security measures to protect sensitive customer information and ensure data privacy.

Disadvantages

Depending on the scale of your operations and the features you require, Sumsub's services may come with a significant cost, especially for smaller businesses or startups with limited budgets.

Integrating Sumsub's KYC solution into existing systems and workflows may require technical expertise and time, especially for businesses with complex infrastructures.

Sumsub's platform may have limitations in terms of customization options, which could be a disadvantage for businesses with specific or unique KYC requirements.

As your business grows, you may encounter scalability challenges with Sumsub's platform, such as increased verification times or limitations in handling a larger volume of KYC requests.

SEON

SEON KYC solution offers a set of fraud prevention tools, including device fingerprinting, behavioral analytics, and IP geolocation. The platform supports identity verification via document checks, biometric authentication, and social media analysis. Users can create custom rules and thresholds to tailor fraud detection strategies to their specific needs.

SEON enables real-time monitoring of transactions and user activities, enabling proactive intervention to prevent fraudulent behavior. Its transparent pricing model ensures clarity and predictability in costs, making it accessible to businesses of all sizes.

Advantages

SEON integrates with various data sources to enrich customer profiles, providing businesses with additional insights to make more informed decisions during the KYC process.

SEON offers real-time monitoring capabilities, allowing businesses to detect suspicious activities as they occur and take immediate action to mitigate risks.

SEON employs advanced fraud detection techniques, such as device fingerprinting and behavioral analysis, to identify and prevent fraudulent activities during the KYC process.

Disadvantages

SEON’s advanced features may require a learning curve for users unfamiliar with fraud prevention technologies. Integrating the platform into complex IT environments may pose challenges, and effective utilization of SEON may require dedicated resources for configuration, monitoring, and optimization.

Accuracy and False Positives: Like any automated system, SEON's KYC processes may sometimes generate false positives, flagging legitimate customers as suspicious. This can lead to inconvenience for customers and potentially harm the user experience.

Limited Customization: SEON's KYC solutions may have limited customization options, which could be a drawback for businesses with specific or unique KYC requirements.

Shufti Pro

Shufti Pro KYC system offers global coverage for identity verification and KYC compliance, supporting multiple languages and document types. The platform provides real-time identity verification with AI-powered document analysis and facial recognition. Shufti Pro helps businesses comply with regulatory requirements, including General Data Protection Regulation (GDPR), Payment Services Directive 2 (PSD2), and AML (Anti-Money Laundering) regulations.

Advantages

It offers flexible integration options, including APIs, SDKs, and plugins for popular CMS platforms, and users can customize verification workflows and thresholds to meet specific business needs and regulatory standards.

Shufti Pro utilizes advanced AI and machine learning algorithms to accurately verify identity documents and facial biometrics, minimizing the risk of errors in the verification process.

Shufti Pro offers a range of verification methods, including document verification, facial recognition, and biometric authentication, allowing businesses to choose the most suitable method for their needs.

Shufti Pro supports identity verification for customers from around the world, making it suitable for businesses with international operations or customer bases.

Disadvantages

Shufti Pro's services may be costly for smaller businesses or startups, especially if they have a limited budget for KYC solutions.

Some users may find Shufti Pro's interface or integration process complex, particularly if they lack technical expertise or experience with similar platforms.

Some users may encounter challenges with Shufti Pro's customer support, such as delays in response times or difficulty resolving issues effectively.

iDentify

iDentify KYC software offers identity verification services through document checks, biometric authentication, and facial recognition. The platform integrates AML screening capabilities to identify and mitigate money laundering risks, and it employs fraud detection algorithms and machine learning models to detect and prevent fraudulent activities.

Advantages

iDentify’s intuitive interface makes it easy for users to navigate and perform identity verification tasks efficiently. The platform helps businesses stay compliant with regulatory requirements, and its scalable architecture accommodates businesses of all sizes. Users can customize verification workflows and settings to align with specific business needs and compliance standards.

Minimize user onboarding costs and save more. Pay only per successful ID verification, save up to 70% of user onboarding costs, and increase the volume of quality customers by preventing fraudulent accounts.

Ai-powered. Verify customer IDs with AI-powered biometric recognition service. Ensure quality identity verification with iDenfy’s team that manually reviews every audit.

Disadvantages

iDentify may have limited integration options compared to other KYC service providers, potentially restricting its compatibility with certain systems and applications. Some users may find its feature set to be less comprehensive, particularly in terms of advanced fraud prevention capabilities.

Another disadvantage of iDentify is custom pricing. Without listed pricing tiers, it can be difficult to compare costs upfront with other services.

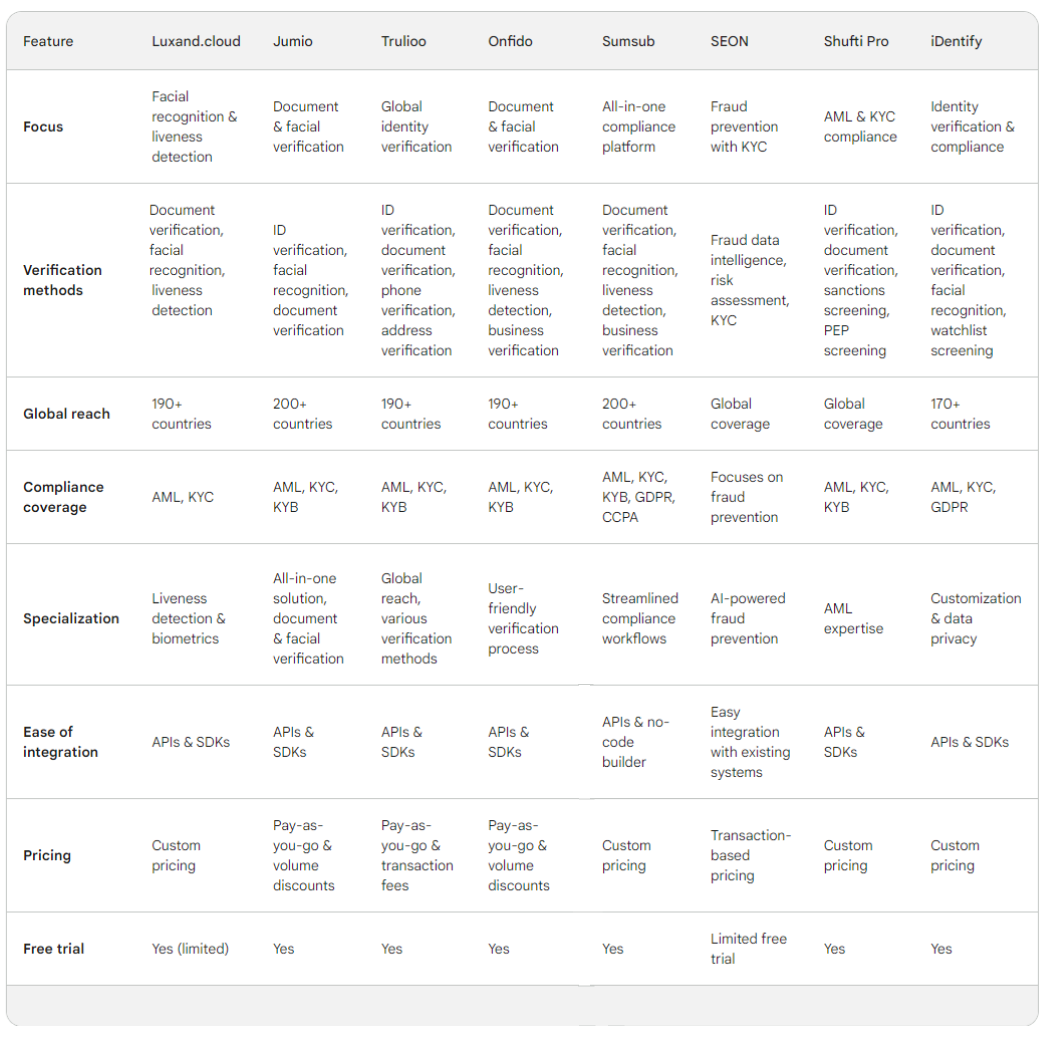

Top KYC Services - A Table of Comparison

How to Choose the Right KYC Solution for Your Business

Pay attention to all these questions to choose the right solution for your business.

KYC Compliance

Regulations. Identify the KYC/AML regulations that apply to your business and industry. Different regions have varying requirements

Coverage. Does the solution cover the verification methods and checks mandated by your regulations?

Business Needs

Customer base. Consider the volume and location of your customers. Does the solution effectively verify identities from those regions?

Verification levels. What level of verification is necessary for your business? Do you need basic ID checks or more advanced features like document verification and liveness checks?

Scalability. Will the solution accommodate your business growth and future needs?

Technical Considerations

Integration. How easily can the KYC solution integrate with your existing systems?

Security. Does the provider offer robust security measures to protect sensitive customer data?

User-friendliness. Is the solution easy to use for both your customers and your internal team?

Additional Factors

Cost. KYC solutions can vary significantly in cost. Consider pricing models and if they fit your budget.

Customer support. Evaluate the quality and availability of customer support offered by the provider.

Reputation. Research the provider's reputation — read some reviews on popular review platforms like G2, Capterra, Trustpilot.

Conclusion

The landscape of KYC services in 2024 offers a diverse array of options, each with its unique features, benefits, and drawbacks. From advanced biometric authentication to comprehensive screening and monitoring capabilities, businesses have a wide range of options to ensure compliance, mitigate risks, and deliver a seamless customer experience.

However, selecting the right KYC service requires careful consideration of factors such as regulatory requirements, industry-specific needs, budget constraints, and scalability. By evaluating the features, benefits, and drawbacks of each option, businesses can make an informed decision and find the perfect fit for their organization.