Identity Verification for Financial Services

Identity verification is a crusial process for financial institutions to prevent fraud and money laundering. For this case, Luxand.cloud offers KYC and biometric authentication solutions to verify identities and streamline customer onboarding processes.

Get Free API RequestsRequest Free DemoReady-Made Solutions

Control

Detection

for KYC

How Luxand.cloud Benefits the Finance Industry

Remote Onboarding

Streamline the new customer onboarding process while minimizing the need for in-person customer validation.

Get Free API Requests Get Free API Requests

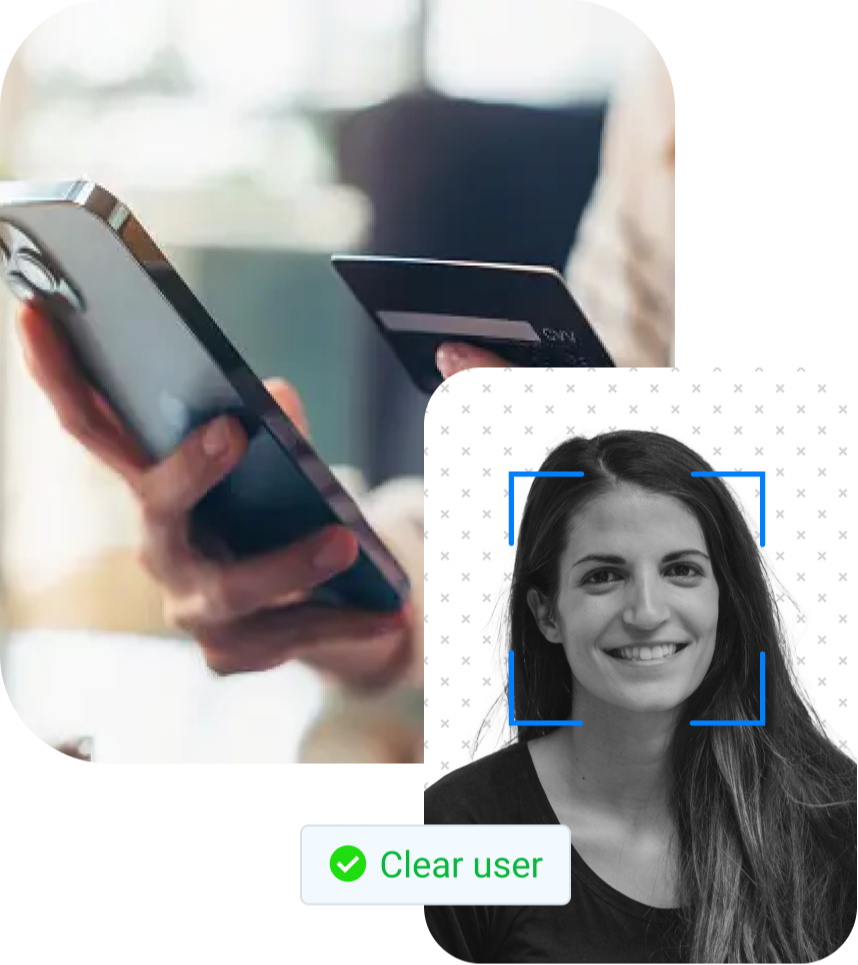

Get Free API RequestsBiometric Authentication

Biometric verification goes beyond traditional methods, adding an extra layer of security that safeguards valuable assets and ensures data privacy during critical transactions.

KYC Compliance

Provide a robust and secure digital platform that empowers seamless financial transactions which meet KYC/AML compliance.

Get Free API Requests Get Free API Requests

Get Free API RequestsHigh Risk Transactions

Luxand.cloud automated KYC system can analyze vast amounts of data to identify patterns and anomalies that may indicate high-risk transactions.